The cost of the “Iron Swords” war is estimated at NIS 200 billion over 15 months, and is presented as a huge expense that requires “tightening the belt” and imposing decrees on the public. New policy paper of the Arlozorov Forum of the General Histadrut, demonstrates how the state apparatus can be restored, and economic growth and social welfare can be increased without any cuts at all.

According to the authors, Ido Len and Yoni Ben Bashet, Israel can learn what other developed countries such as Belgium, Austria, the Netherlands and Sweden are doing. In summary – these countries collect much more taxes and give back to citizens services at a much higher level.

The policy paper demonstrates six alternatives to the policy of increasing investment in citizens, and how they will affect other variables, such as the tax burden, the level of debt and economic growth.

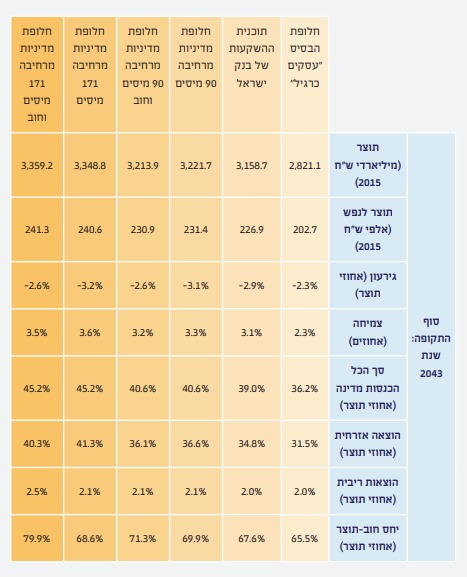

According to the position paper, the worst alternative is the current policy of low spending and low taxation. The second level is the Bank of Israel’s investment increase plan, while the other four alternatives are two levels of massive public investment, each financed by taxes or a combination of taxes and debt.

In the most generous alternative, the forum’s calculations show that the State of Israel can finance an additional investment in citizens to the extent of another “iron swords” each year, without collapsing economically, but on the contrary – to accelerate economic growth and benefit the citizens.

This investment will indeed increase the public debt burden for several years, but after that it will lead to an opposite trend and a decrease in this burden, thanks to economic growth much faster than the current one, and the closing of the investment gaps with other developed countries.

“The war that broke out on October 7 demonstrated to the entire Israeli public the tremendous importance of strong civil services, which can respond to the public in both routine and emergency situations,” write Len and Ben Bashet. “A continuous budget drying process, which lasted for about four decades, and even more so since 2003, brought Israel, on the eve of the war, to a situation where the civil services are thin and weak. Beyond the security-political failure that led to the outbreak of the war, the inadequate functioning of the government ministries and the civil services in our most difficult time, constitutes an equally serious civil omission.”

Len and Ben Bashet mention that at the time the war Mobilization took place tremendous of volunteers and of organizational Company civilian, But when looking at the long term, in This is the solution. According to them, “in order for services basic will be given to all the citizens, with no discrimination and along all this year, on them rely on On the government and on its budgets the public ones. therefore, we are focusing in the proposal alternatives Finances to increase the expense the civil“.

The main source for a functioning state: raising taxes

The macroeconomic model built by the researchers is first of all based on tax increases, some of which can be replaced by increasing the debt. According to the position paper, it is better to postpone the tax increases until 2028, so that the public will first feel the benefits of a large government and a functioning public sector, and only then will they gradually be required to bear the burden of the additional financing.

The researchers present a thesis contrary to the one successfully introduced by Prime Minister Benjamin Netanyahu – the “thin man” (the private sector) does not carry the “fat man” (the public sector) on his back, but rather they feed each other.

According to the researchers, today the public sector is so financially starved that the entire economy is lagging behind developed countries with a much larger public sector. According to the model we built, the fastest way to increase GDP per capita in Israel is to dramatically increase public investment.

Thus, without a policy change, GDP per capita will increase from 168.5 thousand shekels today, to 202.7 thousand shekels in 2043. A relatively modest investment plan presented by the Bank of Israel will increase the amount to 226.9 thousand shekels, while a massive public investment (171 billion shekels each year) Bring the GDP per capita to NIS 240.6 thousand.

GDP per capita according to the position paper (photograph from the Arlozorov Forum report)

The price of this policy may sound high – An increase in the debt-to-GDP ratio from 65% today to almost 85% in 2030, then a decrease to 79.9% in 2043. In practice, the cost is not expected to be so dramatic – An increase in interest payments from 2% GDP per year to 2.6% GDP at most, in a scenario where the large investment is only partially financed by taxes, and only then by debt.

In addition, after the year 2043, the debt burden will continue to decrease slowly in the trend of stabilizing at a level of less than 60%, and with it the interest burden will also decrease.

The various alternatives as presented in the position paper (photograph from the Arlozorov Forum report)

Shatter the myth of civil spending in Israel

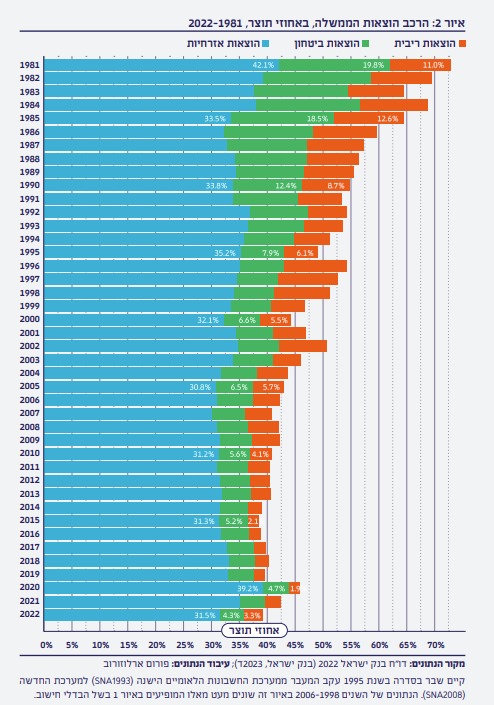

The composition of government expenditures as a percentage of GDP 1981-2022 (photograph from the Arlozorov Forum report)

According to the researchers, the historical data of the division of public spending in Israel into defense spending, civilian spending and interest payments, shows that a dramatic decrease in security spending and interest spending was not really directed in favor of improving service to the citizen, while civilian spending actually decreased over the years, from 42.1% of GDP in 1980 , to 31.5% in 2022 – A huge gap of about NIS 171 billion every year than the average of theOECD.

Therefore, the argument according to which the low civilian spending is caused by high defense spending in Israel is not clear-cut, and the real dilemma is between “big government” and “lean government”.

An optimistic project

According to Len and Ben Bashet, the financing alternatives they presented in the paper “The day after the war“ You are promoting an optimistic project of changing direction. “Bdiscourse the public the Israeli take root the concept ‘government greatness‘ On portion describe government ‘inflated‘, With Much singing and offices unnecessary“, the report said.

“in reviews of project ‘Today that after’, we users in meaning the professional of the concept ‘government greatness‘: government that employs Much sisters, teachers, facts Sociality, female police officers and my employees public many more, and pays to them wage appropriate, that attracts You the best and the good ones most to the service the public. in words others, we offer to choose in policy of government greatness, such a who is responsible to the fields vital many in my life the everyday of the citizens, gives Services Civilians high quality, accessible and universal, and provides Network security socially crowded“.

The real challenge is not the money

The position paper does not propose a mix of specific taxes that should be raised, and also hardly deals with the political issue – What will bring the public to support a dramatic increase in government spending and taxes, as well as what will ensure that the money is invested for the benefit of all citizens without sectoral discrimination.

MK Yair Lapid and Minister Moshe Arbel. Among the few who spoke otherwise (Photos: Aryeh Lev Abrams, Noam Rivkin Fenton/Flash90)

Another question is where will all the people who are supposed to provide stronger and better quality medical, education, police and community services come from.

The benefit of the project’s macroeconomic model is the calculation that shows that the real challenge is not the money. According to the authors, there is no real difficulty in Israel behaving like most developed countries and dramatically increasing investment in civilians, even during the war and major defense investments at least until 2030.

In Israel, a consensus was established in economic thought, according to which an increase in public spending is a disaster. Among the few who said something different, and that too in a one-time manner, are the head of the opposition Yair Lapid (Yesh Atid), who expressed support for a policy amendment The strangulation of civil expenditure, and minister The head of Shas, Moshe Arbel, who spoke against the budget cuts.

Against this consensus, the policy paper of the Arlosorb Forum constitutes an important diversification to the economic discourse in Israel.

#Research #country #restored #increase #growth #cuts

2024-03-14 23:50:40